Irrevocable trusts cant be modified amended or terminated without the permission of the beneficiary. Expert asset protection since 1906.

How A Trust Can Protect Your Assets From Divorce

Maximize on the Equity of your Property.

. Broadly speaking trusts can shield your assets from divorce because assets in a trust are not owned by you. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Since a Revocable Trust is revocable meaning you still have control over the assets your assets held in said trust.

Get Help From Fidelity At Every Step. Ad With Access To Our Free Estate Planning Checklist You Can Start Developing A Plan Today. It is certainly there for your benefit but it also benefits your children and.

Trusts That Can be Used to Protect Assets in a Divorce. Expert asset protection since 1906. A common question for anyone generating a degree of wealth is how can I protect my assets from divorce and can trusts protect assets from divorce.

Ad 1 Million customers served. Customize in Minutes for Immediate Use. If assets are held in a trust they may be exempt from the rules of equitable distribution.

Of course it is important to be. A trust protects your assets in many ways but in California the. The short answer is the.

Ad Protect your financial privacy. In the event of a divorce you would have the trust to rely on because it is not your asset it is owned by a trust. An irrevocable trust wont.

If youve recently been divorced you can use a trust among other techniques to protect your post-divorce assets from creditors or from lawsuits. The Court can treat Trust assets as income or capital available to one spouse and therefore available for division between the parties. Generally speaking asset protection trusts are irrevocable self.

Ad Avoid Probate and Save Time for Your Loved Ones by Creating a Free Living Trust. Living Trust Template Online. Although judges will typically distribute assets equally or based on the principle of fairness a carefully timed and worded irrevocable trust may effectively shield your.

Ad Learn The Divorce Dos Donts. A trust can also help protect your assets from being given to your childs spouse in the event of a divorce. Call To Learn More.

Ad Protect your financial privacy. Ad Well Protect Your Rights Help You Resolve Legal Disputes Fast. The reason is that the assets of a properly drafted trust remain.

Get Premium Client Service From Our Experienced Divorce Lawyer. From Fisher Investments 40 years managing money and helping thousands of families. You can protect the real estate assets you.

This can complicate matters when spouses file for divorce and. Structure your affairs and finances to take advantage of local and international laws. A Revocable Trust will not protect or exclude your assets in an Indiana divorce.

Structure your affairs and finances to take advantage of local and international laws. Here are three key ways to protect yourself from losing your real estate in case of divorce. Asset protection trusts are one of the strongest legal vehicles for asset protection during and after divorce proceedings.

Request Your Free Estate Planning Guide Today And Get The Investment Information You Need. Trusts and prenuptial agreements are different documents that serve distinctly different purposes. Trust property is owned by the trust itself a legal entity.

Trusts may be used to protect assets when. Uncontested Divorce Child Spousal Support. This holds even when one spouse creates an irrevocable trust for the.

In order to be valid there must be an. Because our daily lives are filled with liability. There are many tools you can use in estate planning to protect your assets and a trust is one of them.

Irrevocable trusts cannot be modified or revoked by the Trustor at any time or for any reason once executed. The written terms cant be changed. Recently divorced women can use trusts and other techniques to protect their post-divorce assets from lawsuits and creditors.

Aside from being used as an estate planning tool trusts can be used for asset protection in divorce. Giving the trustee andor trust protector the authority to remove beneficiaries who are involved in divorce proceedings is one way to protect trust assets. When a couple divorces property is divided according to the laws of the.

But can a trust be set up to protect your own assets in the event of a divorce in the state. When going through a divorce in Florida irrevocable trusts are not considered marital property.

Does A Living Trust Protect Your Assets From Lawsuit Bratton Estate Elder Care Attorneys

How To I Protect My Things And Qualify For Medicaid Medicaid Estate Planning How To Plan

Can A Trust Protect My Assets During A Divorce Webster Garino Llc

How Can I Protect Specific Assets In A California Divorce Renkin Law

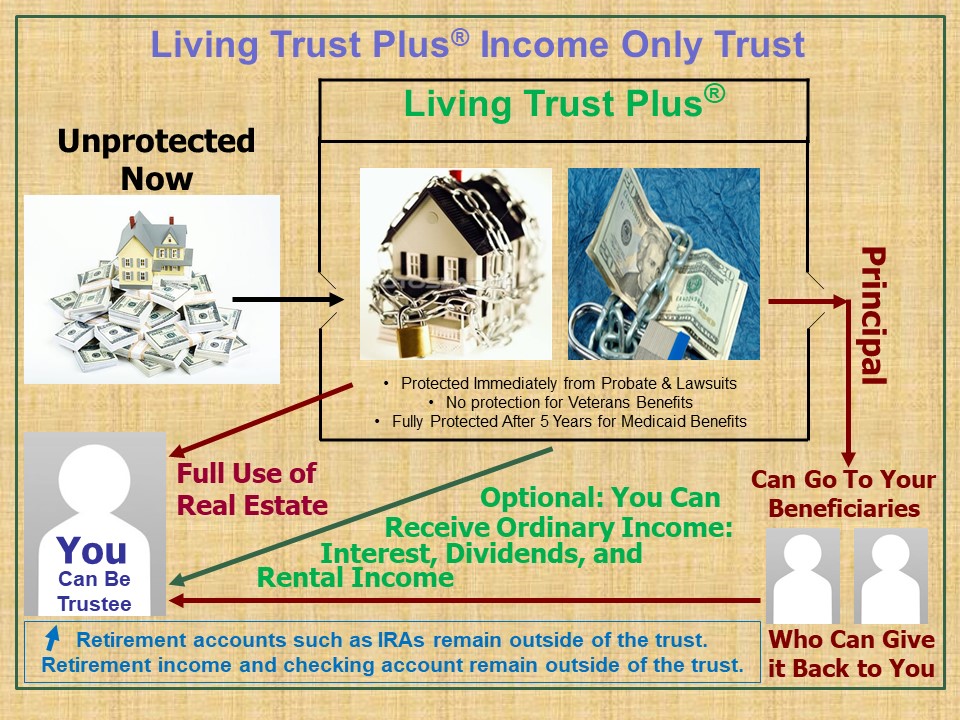

Living Trust Plus Frequently Asked Questions Farr Law Firm

How Protected Are Your Assets In The Event Of Divorce

Using A Trust To Protect Assets In Divorce Proceedings Gudorf Law Group

0 comments

Post a Comment